how does the arizona charitable tax credit work

Any government-issued ID that includes a photograph will work such as a drivers license passport or state identification card. The Arizona Department of Revenue ADOR is reminding businesses that have not renewed their 2022 Transaction Privilege Tax TPT License to complete the licensing renewal processClick here for more information.

The Arizona Tax Credit Give Local Old Pueblo Community Services

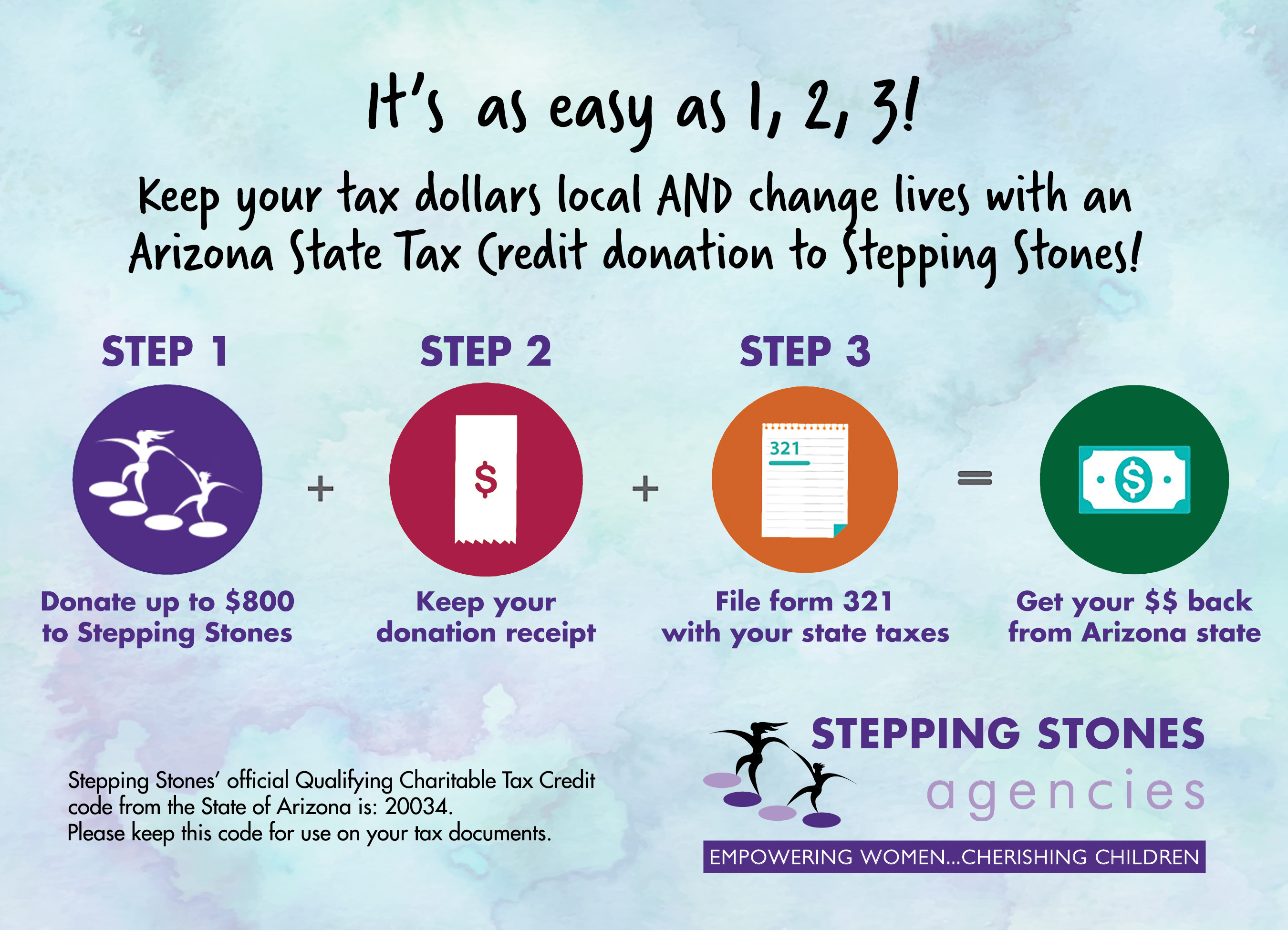

Tax credits claimed for qualifying contributions to qualified charitable organizations Credit Forms 321 322 323 348 and 352 cannot be claimed on Form 301-SBI and must be claimed on the taxpayers regular tax return.

. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5. More information is available at the AZ Department of Revenue website. Arizona collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

An individual income tax credit is available for contributions that provide assistance to the working poor. How does the Tax Foundations tax-scoring model work. The law does not affect the above-the-line deduction for taxes incurred and paid in an active trade or.

Users may rely on this list in determining deductibility of their contributions. See page 27 for details. Arizona residents can still utilize the Arizona Charitable Tax Credit Public School Tax Credit Credit for Contributions to Private School Tuition Organizations and other individual tax credits to support state-certified charities and receive dollar-for-dollar state tax credits.

Christian Family Cares Qualifying Foster Care Charitable Organization code is 10024. Nebraskas maximum marginal income tax rate is the 1st highest in the United States ranking directly. The WOTC also applied to any employee who lived in the Gulf Opportunity GO Zone when Hurricane Katrina hit and who was employed in that zone through.

Our qualifying charitable tax credit id is 20488. Even though your employer should report your income directly to the IRS your tax preparer will also need the information on your W-2 forms to complete your tax forms. Because their tax-exempt application is public record then yes bylaws are public record by extension.

Like the Federal Income Tax Arizonas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. You may also be able to claim your gift as a charitable deduction on your federal taxes. Charitable contributions made to the Community Food Bank of Southern Arizona may qualify the donor for a maximum tax credit of as much as 400 or 800.

Federal tax policies could impact factors like GDP wages jobs federal revenue and the distribution of the. To schedule an appointment please contact us at email protected. Arizonas maximum marginal income tax rate is the 1st highest in the United States ranking directly.

Organizations whose federal tax-exempt status was automatically revoked for not filing a Form 990-series return or notice for three consecutive years. You should be able to get a copy of either the bylaws. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early.

Please consult your tax advisor for any questions related to. To apply for certification an organization must fill out and submit the form below along with all required attachments. 43-1701 also establishes a Credit for Income Taxes Paid to.

Individual taxpayers now have to reduce any corresponding federal tax deductions by these credits however. The charitable checkoffs listed on Form 40 have changed. We also make sure our Bigs and our staff have the training and resources they need to help Littles on their path to success.

Organizations eligible to receive tax-deductible charitable contributions. You can now donate all or part of your refund to the Veterans Suicide Prevention and Outreach Program. Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return.

The credit is available only to individuals. Perhaps the hospital administrator will help you out a little further. A tax credit is available under section 574773 of the Ohio Revised Code for qualified donations to scholarship granting organizations certified by the Attorney General.

You must also total your nonrefundable individual tax. You will be contacted by a compliance examiner from the Charitable. Like the Federal Income Tax Nebraskas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

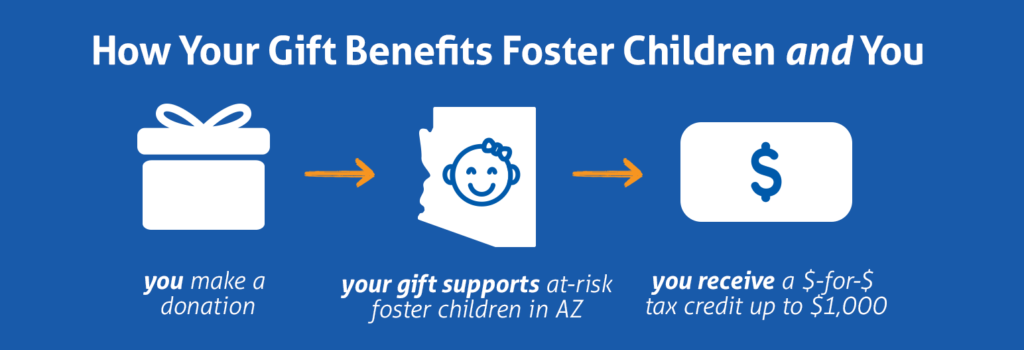

Schedule a clothing donation pick up. To receive the Arizona Foster Care Tax Credit make your gift above. Arizona state income tax rates range from 259 to 450.

For tax years 2018 through 2025 the Tax Cuts and Jobs Act of 2017 TCJA limits individual itemized deductions for state and local sales income and property taxes referred to as SALT and SALT deductions in the case of trusts and estates. You report the name of the Qualifying Charitable Organization you donated to as well as the dollar amount of your donation to the Department of Revenue on Form 321. When a nonprofit files for tax-exempt status with the IRS they must include a copy of their bylaws in addition to the application.

To achieve the highest standards possible we work constantly to review and strengthen our background check systems as new best practices in the industry emerge. If you hold more than one job youll need to. Tax Credits Rebates Savings Page.

We recommend asking your tax advisor to help you claim the dollar-for-dollar credit when you file your Arizona state tax return. See page 27 for more details. If youre familiar with our work you may know that we produce estimates for how different US.

The restoration of the state charitable deduction was triggered. Get your tax refund up to 5 days early. Just because an organization appears on.

The deduction uses the federal charitable deduction as its starting point but will be available to Massachusetts taxpayers regardless of whether they itemize their deductions or claim the standard deduction. Its an investment in a. To schedule an appointment please contact us at email protected.

Nebraska collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Businesses can receive up to a 240000 tax credit the Work Opportunity Tax Credit or WOTC for the first year of employment of a new employee between the ages of 18 and 39 who lives and works in either an RC or an EZ. Oregon is tied to the federal definition of taxable income with two exceptions.

Massachusetts has a new income tax deduction for charitable contributions as of tax year 2021. Its not just a donation. The Arizona Department of Revenue ADOR is reminding businesses that have not renewed their 2022 Transaction Privilege Tax TPT License to complete the licensing renewal processClick here for more information.

The limitation is 10000. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. Credit for Income Taxes Paid to Other States Arizona Credit Form 309-SBI SB 1783 ARS.

Arizona S Charitable Tax Credit 2020 Fsl Org

Tax Credit Charitable Giving For Free Fsl

![]()

Qualified Charitable Organizations Az Tax Credit Funds

Az Tax Credit Information Emerge

Qualified Charitable Organizations Az Tax Credit Funds

List Of 6 Arizona Tax Credits Christian Family Care

3 Tips For Calculating Your State Tax Liability Fsl

Still Time To Help Local Families With A Tax Credit Donation Stepping Stones Agencies

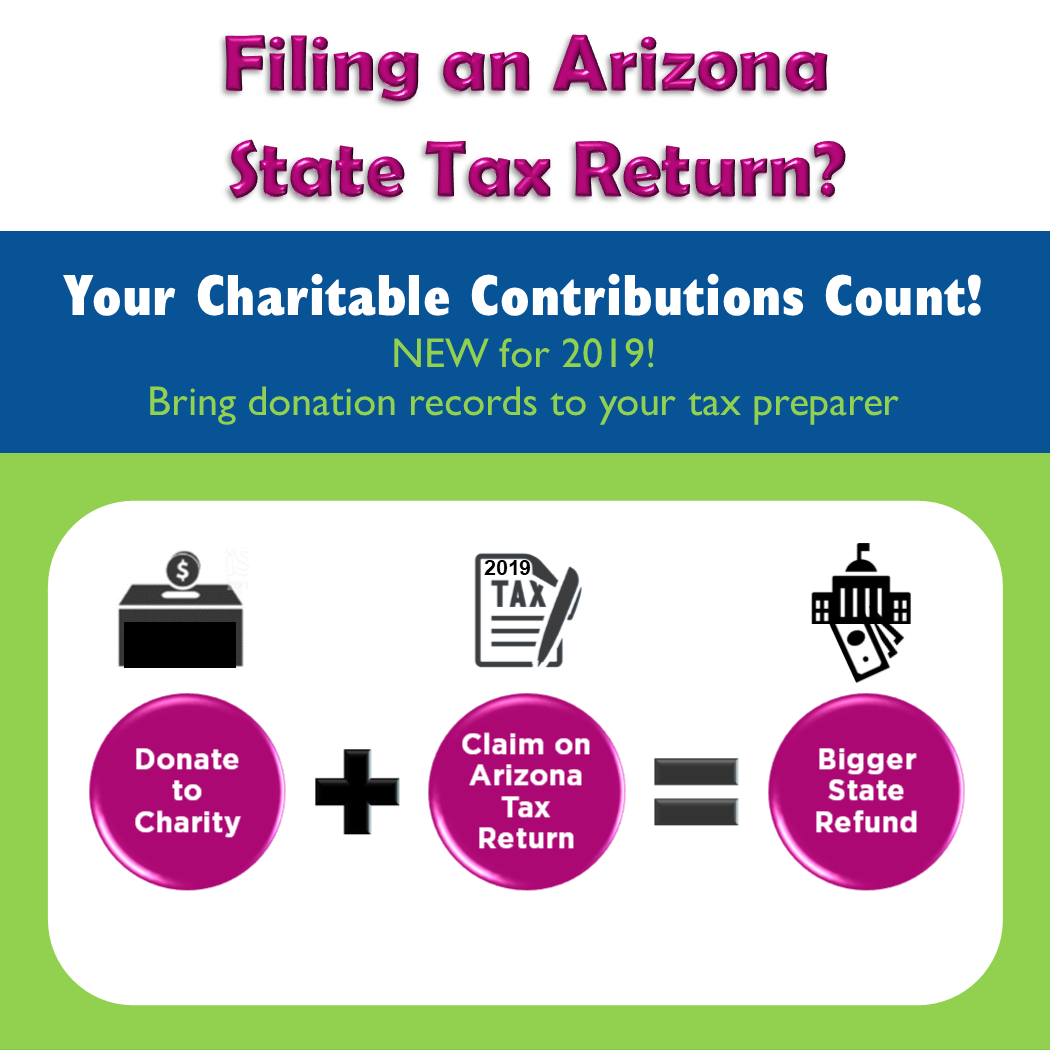

Charitable Contributions Count In Arizona Tempe Community Council

Tax Credit Central Arizona Shelter Services

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Charitable Tax Credit Can Benefit Hcc

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

Arizona Charitable Tax Credit Guide 2020 St Mary S Food Bank

Arizona Charitable Tax Credit Fund Paradise Valley Community College